The Bull Is Back… Will It Keep Charging?

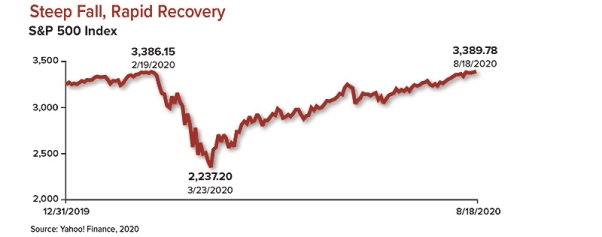

On August 18, 2020, the S&P 500 set a record high for the first time since COVID-19 ushered in a bear market on February 19. The cycle from peak to peak was just 126 trading days, the fastest recovery in the history of the index, erasing losses from an equally historic plunge of almost 34% in February and March.1

Based on the traditional definition of market cycles, the new record confirms that a bull market began on March 23 when the index closed at its official low point. This also confirms that the February-March bear market was the shortest on record, lasting just 33 days.2

Although the strong comeback is good news for investors, there is a striking disconnect between the buoyant market and an economy still struggling with high unemployment and a public health crisis. The market is not the economy, but the economy certainly affects the market. So it may seem puzzling that the market could reach a record high not long after the largest quarterly decline in gross domestic product (GDP) in U.S. history.3

Optimism vs. exuberance

Whereas GDP measures current economic activity, the stock market is forward looking. The rapid bounceback suggests that investors believe the pandemic will be controlled in the not-too-distant future and that business activity will return to normal. Whether this optimism is warranted remains to be seen. The current economic situation remains tenuous, but there are hopeful signs.

A vaccine could be available in early 2021, later than anticipated but offering light at the end of the tunnel.4 In the meantime, the virus continues to suppress business activity. The 10.2% July unemployment rate represented a big improvement over the previous three months, but it was still higher than at any time during the Great Recession.5 Recent projections of corporate earnings suggest they will not contract as much as expected, but they will still contract.6 GDP is projected to make up ground in the third and fourth quarters but remain negative for the year.7

The extreme of market optimism is irrational exuberance, and there may be some of that at work in the current situation. The proliferation of low-cost trading apps has encouraged less-experienced investors to trade aggressively, which might be driving some of the market surge.8

Economic stimulus

The single, most important factor behind the market recovery is the deep commitment from the Federal Reserve to provide unlimited support through low interest rates and bondbuying programs. For some investors, the fact that the economy is still struggling has a strangely positive effect in guaranteeing that the Fed will keep the money flowing.9

Further support from the federal government is more uncertain, but the strong market suggests that investors may be counting on a second stimulus package.10

Nowhere else to go

Low interest rates make it easier for businesses and individuals to borrow, but they have reduced bond yields to the point that many investors are willing to take on greater risk in equities in order to generate income. Money that might normally be invested in the bond market has poured into stocks, driving prices higher. This situation has its own acronym: TINA, There Is No Alternative to Stocks.11

Big tech at the wheel

While the S&P 500 is generally considered representative of the U.S. stock market as a whole, the recovery has centered around technology companies, which have helped provide goods and services throughout the pandemic. The Big Six tech stocks — Apple, Facebook, Amazon, Netflix, Microsoft, and Alphabet (Google’s parent) — were up collectively by more than 43% for the year through August 18. By contrast, the rest of the companies in the S&P 500 were down collectively by about 4%. The Big Six tech companies now represent more than one-fourth of the total market capitalization of the S&P 500 and thus have an outsized effect on index performance.12

One question facing investors is whether to chase the winners or look to stocks and sectors that still lag their previous highs and may have greater growth potential. Chasing performance is seldom a good idea, but there are solid reasons why certain stocks have been so successful in the current environment.

Are stocks overvalued?

The most common measure of stock value is price/earnings (P/E) ratio, which represents the stock price divided by corporate earnings over the previous 12 months or by projected earnings over the next 12 months. The projected P/E ratio for the S&P 500 on August 18 was 22.6, the highest since March 2000 at the peak of the dot-com bubble. Big tech stocks were even higher, trading at 26 times their projected earnings, and the Big Six were higher still at more than 40 times projected earnings.13-14

A different measure of stock value compares the total market capitalization of all U.S. stocks with GDP. By this measure, the market was 77.6% overvalued on August 18, by far the highest valuation ever recorded. The previous highs were 49.3% in January 2018 and 49.0% in March 2000. This extreme ratio illustrates the current disconnect between the stock market and GDP, but a significant GDP increase during the third quarter could bring it down.15

In considering these valuations, keep in mind that these are extraordinary times, and traditional expectations and measures of value may not tell the whole story. If nothing else, the extreme volatility and rapid market cycles of 2020 have illustrated the importance of maintaining a diversified all-weather portfolio and the danger of overreacting to market movements. While new records are exciting, they are only signposts along the road to achieving your long-term goals.

The return and principal value of stocks and bonds fluctuate with changes in market conditions. Shares, when sold, and bonds redeemed prior to maturity may be worth more or less than their original cost. Investments seeking to achieve higher yields also involve a higher degree of risk. Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss. The performance of an unmanaged index such as the S&P 500 is not indicative of the performance of any specific investment. Individuals cannot invest directly in an index. Past performance is not a guarantee of future results. Actual results will vary.

Insights delivered right to your inbox | Sign up

[mc4wp_form id=”1812″]

WE’RE HERE TO HELP

Questions? Email us at invest@peakeadvisors.com

For disclaimer, please follow our link below:

https://www.peakeadvisors.com/site/wp-content/uploads/2019/05/Compliance-Social-Media-Disclaimer.pdf